All Categories

Featured

Table of Contents

Picking to purchase the real estate market, supplies, or various other conventional kinds of possessions is prudent. When determining whether you need to invest in certified financier opportunities, you must balance the trade-off you make between higher-reward potential with the absence of coverage needs or regulatory transparency. It needs to be stated that private positionings involve higher degrees of danger and can on a regular basis represent illiquid investments.

Particularly, nothing right here ought to be interpreted to state or suggest that previous outcomes are an indication of future efficiency nor need to it be translated that FINRA, the SEC or any various other protections regulatory authority accepts of any one of these safeties. Furthermore, when assessing exclusive positionings from sponsors or firms supplying them to accredited financiers, they can offer no guarantees expressed or indicated regarding precision, completeness, or results obtained from any type of details provided in their discussions or discussions.

The firm needs to offer details to you via a file called the Exclusive Positioning Memorandum (PPM) that offers a much more in-depth description of expenditures and threats connected with taking part in the financial investment. Rate of interests in these bargains are just supplied to individuals who qualify as Accredited Investors under the Stocks Act, and a as defined in Section 2(a)( 51 )(A) under the Business Act or an eligible staff member of the monitoring business.

There will certainly not be any type of public market for the Passions.

Back in the 1990s and very early 2000s, hedge funds were recognized for their market-beating efficiencies. Normally, the supervisor of an investment fund will certainly set aside a part of their offered possessions for a hedged bet.

How do I get started with Private Real Estate Investments For Accredited Investors?

For instance, a fund supervisor for an intermittent field may devote a section of the properties to supplies in a non-cyclical industry to offset the losses in situation the economic climate storage tanks. Some hedge fund managers use riskier approaches like using obtained cash to acquire even more of a possession just to multiply their potential returns.

Similar to shared funds, hedge funds are professionally taken care of by profession financiers. Hedge funds can apply to various investments like shorts, alternatives, and by-products - High-Yield Real Estate Investments for Accredited Investors.

What types of Accredited Investor Real Estate Partnerships investments are available?

You might select one whose investment viewpoint aligns with your own. Do remember that these hedge fund money supervisors do not come low-cost. Hedge funds typically bill a cost of 1% to 2% of the assets, along with 20% of the earnings which functions as a "efficiency fee".

High-yield investments attract lots of financiers for their cash money flow. You can acquire a possession and obtain rewarded for keeping it. Accredited financiers have much more chances than retail investors with high-yield financial investments and beyond. A higher range gives accredited financiers the chance to get greater returns than retail financiers. Accredited capitalists are not your ordinary financiers.

What should I know before investing in Accredited Investor Real Estate Syndication?

You need to satisfy at the very least among the adhering to specifications to come to be a recognized capitalist: You have to have over $1 million total assets, excluding your primary residence. Organization entities count as recognized investors if they have over $5 million in assets under management. You should have a yearly earnings that exceeds $200,000/ yr ($300,000/ yr for partners filing together) You should be a registered investment expert or broker.

As a result, recognized investors have a lot more experience and cash to spread out across assets. A lot of capitalists underperform the market, including certified capitalists.

In enhancement, financiers can build equity with positive cash flow and residential or commercial property appreciation. Genuine estate buildings require significant upkeep, and a great deal can go wrong if you do not have the best team.

Who offers flexible Residential Real Estate For Accredited Investors options?

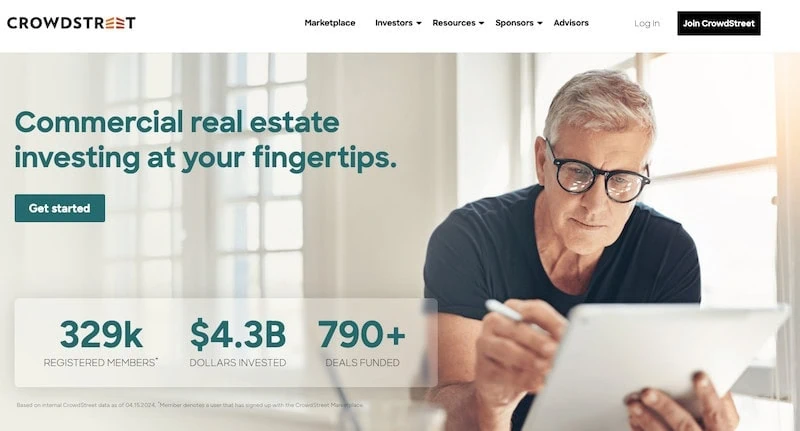

Real estate distributes merge cash from recognized financiers to purchase residential properties straightened with recognized purposes. Certified capitalists merge their cash together to finance purchases and residential or commercial property advancement.

Real estate financial investment trusts need to disperse 90% of their taxable revenue to investors as dividends. REITs enable investors to expand rapidly across lots of residential or commercial property courses with extremely little funding.

What should I look for in a Exclusive Real Estate Crowdfunding Platforms For Accredited Investors opportunity?

Capitalists will benefit if the supply rate climbs since exchangeable financial investments offer them extra attractive entrance factors. If the stock topples, financiers can choose against the conversion and protect their finances.

Latest Posts

Delinquent Property Tax

Tax Sale Blueprint

What Is Tax Lien Certificate Investing